Have you ever wondered how businesses decide the value of their stockpile of products? Or how two companies with the same amount of inventory can report different profits? The secret lies in how they calculate the cost of their inventory. This might sound like a simple task, but with fluctuating prices, it becomes a complex puzzle.

Today, we’re diving deep into the world of inventory accounting, specifically focusing on FIFO, LIFO and WAC methods. By the end of this article, not only will you grasp these concepts, but you’ll also uncover a strategy that could significantly influence your business’s financial health. So, let’s embark on this journey together, and discover the keys to mastering inventory valuation and costing.

The Basics of Inventory Accounting

Inventory accounting is crucial for retail businesses as it directly impacts financial statements and tax calculations. The method you choose for inventory valuation affects your cost of goods sold (COGS), gross profit, and net income. Therefore, selecting the right inventory costing method is more than just compliance; it’s a strategic business decision.

What are FIFO and LIFO?

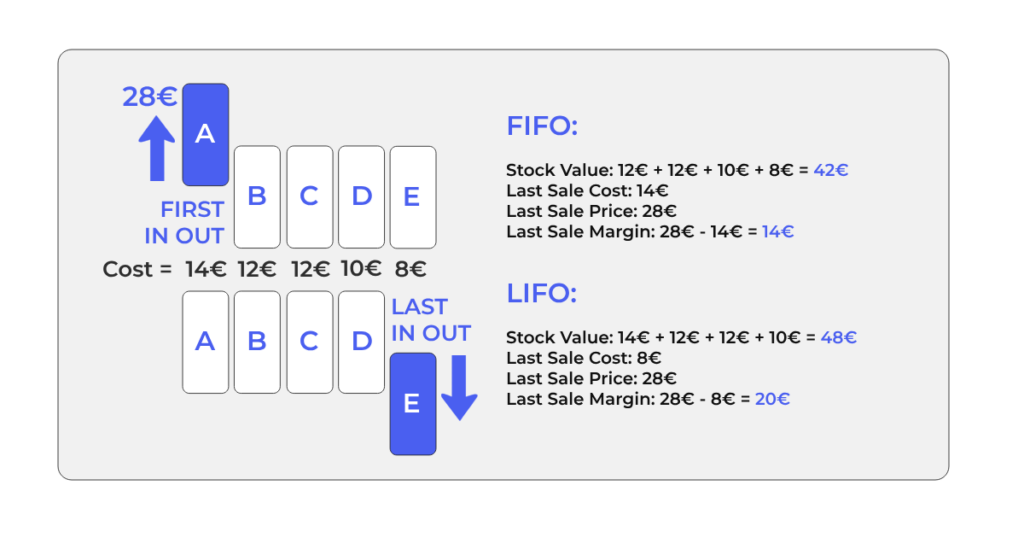

FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) are two widely used inventory valuation methods. Each offers a different approach to inventory costing and can lead to vastly different financial outcomes.

FIFO Accounting

FIFO is a method where the first items added to inventory are the first ones to be sold. This approach assumes that older stock is sold first, which is practical for businesses dealing with perishable goods or products that evolve quickly, like technology or fashion.

Advantages of FIFO:

- Reflects the actual flow of goods for many businesses.

- Prevents inventory from becoming obsolete.

- Typically results in higher profits during inflation.

Disadvantages of FIFO:

- Higher reported profits mean higher taxes.

- Not always reflective of current market prices.

LIFO Accounting

Conversely, LIFO operates on the principle that the last items to enter inventory are the first to be sold. This method can be beneficial during times of rising prices, as it matches current costs with current revenues.

Advantages of LIFO:

- Can lower tax liabilities in periods of inflation by reporting lower profits.

- COGS reflects current replacement costs.

Disadvantages of LIFO:

- Can lead to outdated inventory if older items are never sold.

- Not permitted under International Financial Reporting Standards (IFRS), limiting its use for companies operating internationally.

Weighted Average Cost (WAC)

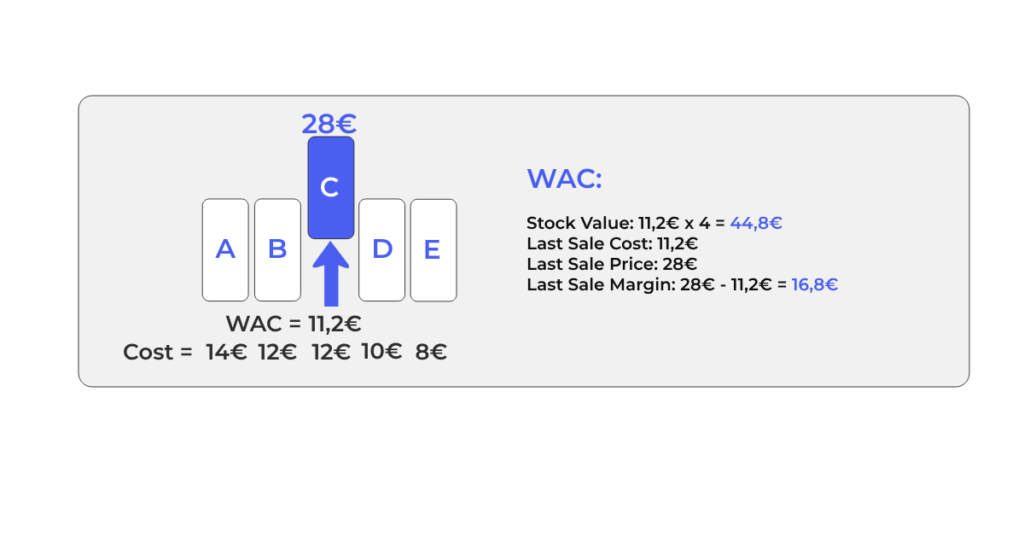

Apart from FIFO and LIFO, there’s another method worth mentioning: the Weighted Average Cost (WAC). This method calculates the average cost of all items in inventory and is used to determine the cost of goods sold and ending inventory value. WAC is beneficial for businesses where individual units are indistinguishable from one another, like fuel or grains.

Choosing the Right Method

Selecting between FIFO, LIFO, and WAC depends on various factors, including the type of products you sell, your business location, and your financial goals. For instance, if you’re in a country that adheres to IFRS, LIFO won’t be an option. Similarly, if managing cash flow is your priority, understanding how each method affects tax liabilities is crucial.

Inventory Valuation Methods and Your Business

Implementing the right inventory valuation method is not just about compliance; it’s a strategic decision that impacts your profitability and financial planning. For retail businesses, choosing between FIFO, LIFO, and WAC can influence how you manage inventory, plan for taxes, and assess your financial health.

Tools to calculate stock value

One of the great advantages of the WAC method is its simplicity. It is also agnostic to price volatility and allows you to have a fairly realistic photo of your margins. The only drawback is that if you don’t have a tool to help you, it can be tedious to constantly have to recalculate the WAC of your products based on each new purchase.

Every time you make a purchase you should recalculate the cost price of all your stock. Adding the weighted price of the new products to that of the products in your warehouse and dividing by the total number of units.

To do this you will need to have good inventory control and a system that does this automatic calculation every time you make a purchase so that when you make a sale you can know exactly what your margins are. Remember that your accountant needs to know the value of your inventory month by month to understand the health of your business, so it is not enough to take inventories every so often. You have to have constant control.

Stockagile can help you automating these processes so do not hesitate to go to request a free demo.

The Impact on Financial Reporting

Inventory valuation directly affects the cost of goods sold, an essential component of your income statement. A higher COGS can decrease your gross profit, which, under LIFO during inflationary periods, can be beneficial for tax purposes. However, it might not present the healthiest picture of your business to investors or lenders, who often prefer the more stable view provided by FIFO or WAC.

Strategic Tax Planning

Your choice of inventory costing method can be a powerful tool in strategic tax planning. FIFO typically results in higher taxes due to higher profits, whereas LIFO can reduce taxable income when prices are rising. Understanding these implications can help you plan your financial strategy more effectively.

Real-World Application and Limitations

While FIFO and LIFO provide frameworks for inventory accounting, real-world application requires a nuanced approach. Market conditions, inventory types, and business objectives all play a role in determining the most advantageous method. Moreover, regulatory requirements and changes in accounting standards can further influence your choice.

Conclusion: The Strategic Advantage of Mastering FIFO and LIFO

FIFO and LIFO accounting are more than just methods to calculate inventory cost; they are strategic tools that can influence your business’s financial landscape. By understanding and applying these methods effectively, you can make informed decisions that optimize profitability, manage taxes efficiently, and align your inventory practices with your business goals. Remember, the best choice depends on a variety of factors, including your specific business circumstances and market conditions. As you navigate the complexities of inventory valuation, consider how each method aligns with your financial strategy to ensure you make the most beneficial choice for your business.

Diving into inventory accounting reveals a world of strategic possibilities. Whether you choose FIFO, LIFO, or WAC, the key is to align your method with your business objectives and market realities. This journey might have started with curiosity, but it ends with a strategic advantage that can elevate your business to new heights.