What is the NIF?

According to Economipedia the technical definition of the NIF is: The Tax Identification Number (NIF) is an alphanumeric code (composed of numbers and letters) used in Spain in order to identify individuals and legal entities in the country for tax purposes.

The code is used in all countries but may have name alterations as we would use different languages or cultures.

Law 58/300 states that all legal entities, individuals and non-personal entities must have a tax number.

NIF for individuals vs. legal entities

We will start by saying that the NIF is different for individuals and legal entities.

- NIF for individuals

By natural person we mean a human being. An individual capable of exercising his or her rights and obligations. It refers to an individual entrepreneur, therefore a self-employed person who exercises an activity on his own account is considered a natural person.

The Tax Identification Number is the same as the DNI for individuals where, as mentioned above, the self-employed would be included.

It consists of 9 characters, 8 numbers and one letter. For example, 22912379A

- NIF for legal entities

On the other hand, legal entities are the entities that define an activity that fulfills the obligations and rights it has. It is normally a group of natural persons with legal personality. It has the capacity independently of its members to be the holder of obligations and rights.

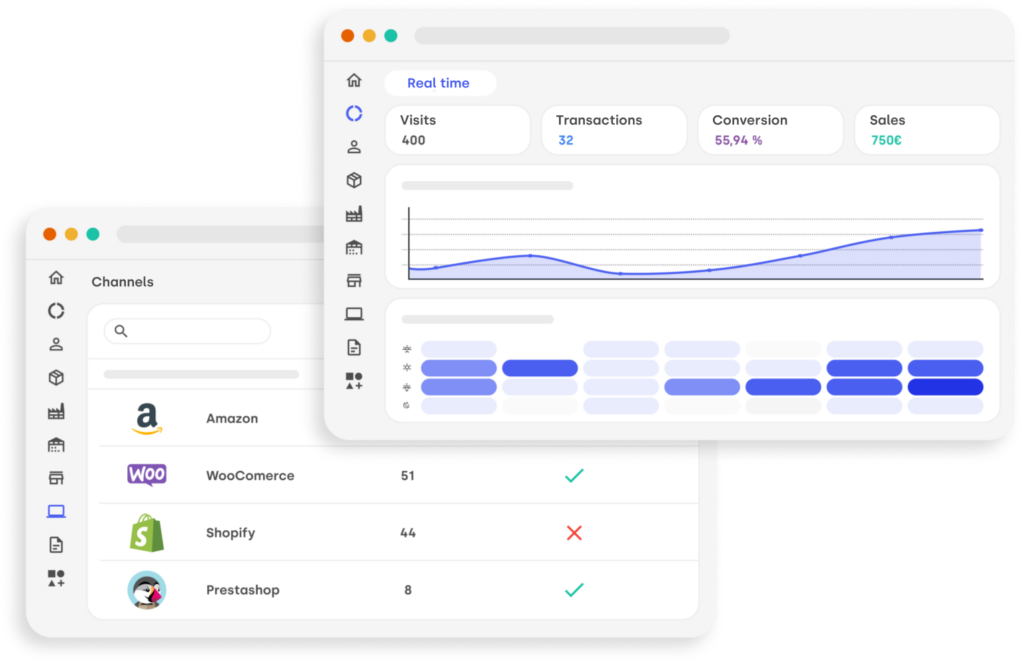

The format of the NIF in this case is different. It is composed of a letter representing the type of company, 7 numbers and a control code. In the image we can see the initial letter assigned to the different legal natures:

And what areits uses?

The Tax Identification Number is used to identify every person when we have to carry out procedures of tax relevance. Every business person, whether legal or natural person, must include the tax identification number (NIF) in the invoices and tax documents generated. There are cases where this code will not be necessary:

- Deeds of incorporation

- Insurance operations

- Contributions to pension plans.

Don’t be left behind! Download now our ebook and discover the difference between traditional ERP systems and Stockagile.

Differences between NIF, DNI and NIE

These three different concepts tend to be confused, so let’s clarify the main differences.

- The National Identity Document (DNI) refers to the identification document of persons with Spanish nationality. It is composed of 8 numbers and one letter. When referring to individuals, the NIF and the DNI are the same; they share the same numbers and the letter.

- On the other hand, when we are talking about a legal entity, the format changes and the DNI cannot be used as an identification document. The NIF then consists of a letter (depending on the nature of the entity), seven numbers and a control code.

- The Foreigner’s Identity Number (NIE) is the document that certifies the legal residence of foreigners in Spain. So for foreigners residing in Spain, the NIE number coincides with the NIF.

To summarize this section, when we talk about individuals, the NIF is the same in the case of Spanish nationals or foreigners with Spanish residence (DNI and NIE respectively).

The CIF no longer exists!

Since 2008, the Tax Identification Code (CIF) is no longer valid for legal entities and companies and is replaced by the NIF.

For companies, the Tax Identification Number is a number just as the CIF was at the time. The letter has the same function as in the CIF and the numbers represent the province where the company is incorporated. In the past, while individuals used the NIF, legal entities used the CIF. Now there is only the NIF, although it is different if it is for individuals or legal entities.